ACC207 - LONG AND SHORT POSITIONS

ANALYSIS: LONG AND SHORT POSITIONS

Essentially, when speaking of stocks, long positions are those that are owned and short positions are those that are owed. An investor who owns 100 shares of XYZ stock is said to be long 100 shares. This investor has paid in full the cost of owning the shares. An investor who has sold 100 shares of XYZ stock without currently owning those shares is said to be short 100 shares. The short investor owes 100 shares at settlement and must fulfill the obligation by purchasing the shares in the market to deliver. Oftentimes, the short investor borrows the shares from a brokerage firm in a margin account to make the delivery. Then, with hopes the stock price will fall, the investor buys the shares at a lower price to pay back the dealer who loaned them.

Essentially, when speaking of stocks, long positions are those that are owned and short positions are those that are owed. An investor who owns 100 shares of XYZ stock is said to be long 100 shares. This investor has paid in full the cost of owning the shares. An investor who has sold 100 shares of XYZ stock without currently owning those shares is said to be short 100 shares. The short investor owes 100 shares at settlement and must fulfill the obligation by purchasing the shares in the market to deliver. Oftentimes, the short investor borrows the shares from a brokerage firm in a margin account to make the delivery. Then, with hopes the stock price will fall, the investor buys the shares at a lower price to pay back the dealer who loaned them.

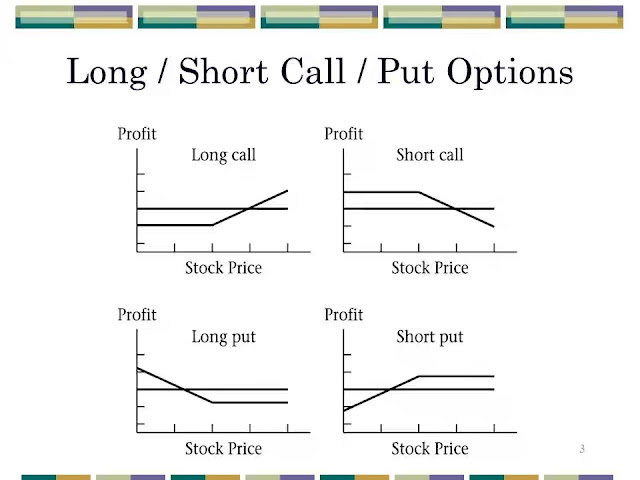

When an investor uses option contracts in an account, long and short positions have slightly different meanings. Buying or holding a call or put option is a long position because the investor owns the right to buy or sell the security to the writing investor at a specified price. Selling or writing a call or put option is just the opposite and is a short position because the investor owes the holder the right to buy the shares from or sell the shares to him at the holder's discretion.

Long and short positions are used by investors to achieve different results, and oftentimes both long and short positions are established simultaneously by an investor to leverage or produce income on a security. A simple long stock position is bullish and anticipates growth, while a short stock position is bearish. Long call option positions are bullish, as the investor expects the stock price to rise and buys calls with a lower strike price. An investor can hedge his long stock position by creating a long put option position, giving him the right to sell his stock at a guaranteed price. Short call option positions offer a similar strategy to short selling without the need to borrow the stock. This position allows the investor to collect the premium as income with the possibility of delivering his long stock position at a guaranteed, usually higher, price. Conversely, a short put position gives the investor the possibility of buying the stock at a specified price and he collects the premium while waiting.

These are just a few examples of how combining long and short positions with different securities can create leverage and hedge against losses in a portfolio. It is important to remember that short positions come with higher risks and, due to the nature of certain positions, may be limited in IRAs and other cash accounts. Margin accounts are generally needed for most short positions, and your brokerage firm needs to agree that more risky positions are suitable for you.